|

Johnson's SU-distribution

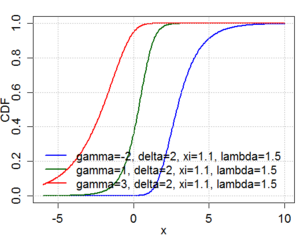

The Johnson's SU-distribution is a four-parameter family of probability distributions first investigated by N. L. Johnson in 1949.[1][2] Johnson proposed it as a transformation of the normal distribution:[1] where . Generation of random variablesLet U be a random variable that is uniformly distributed on the unit interval [0, 1]. Johnson's SU random variables can be generated from U as follows: where Φ is the cumulative distribution function of the normal distribution. Johnson's SB-distributionN. L. Johnson[1] firstly proposes the transformation : where . Johnson's SB random variables can be generated from U as follows: The SB-distribution is convenient to Platykurtic distributions (Kurtosis). To simulate SU, sample of code for its density and cumulative distribution function is available here ApplicationsJohnson's -distribution has been used successfully to model asset returns for portfolio management.[3] This comes as a superior alternative to using the Normal distribution to model asset returns. An R package, JSUparameters, was developed in 2021 to aid in the estimation of the parameters of the best-fitting Johnson's -distribution for a given dataset. Johnson distributions are also sometimes used in option pricing, so as to accommodate an observed volatility smile; see Johnson binomial tree. An alternative to the Johnson system of distributions is the quantile-parameterized distributions (QPDs). QPDs can provide greater shape flexibility than the Johnson system. Instead of fitting moments, QPDs are typically fit to empirical CDF data with linear least squares. Johnson's -distribution is also used in the modelling of the invariant mass of some heavy mesons in the field of B-physics.[4] References

Further reading

Information related to Johnson's SU-distribution |

||||||||||||||||||||||||||||||||||||||||||||||